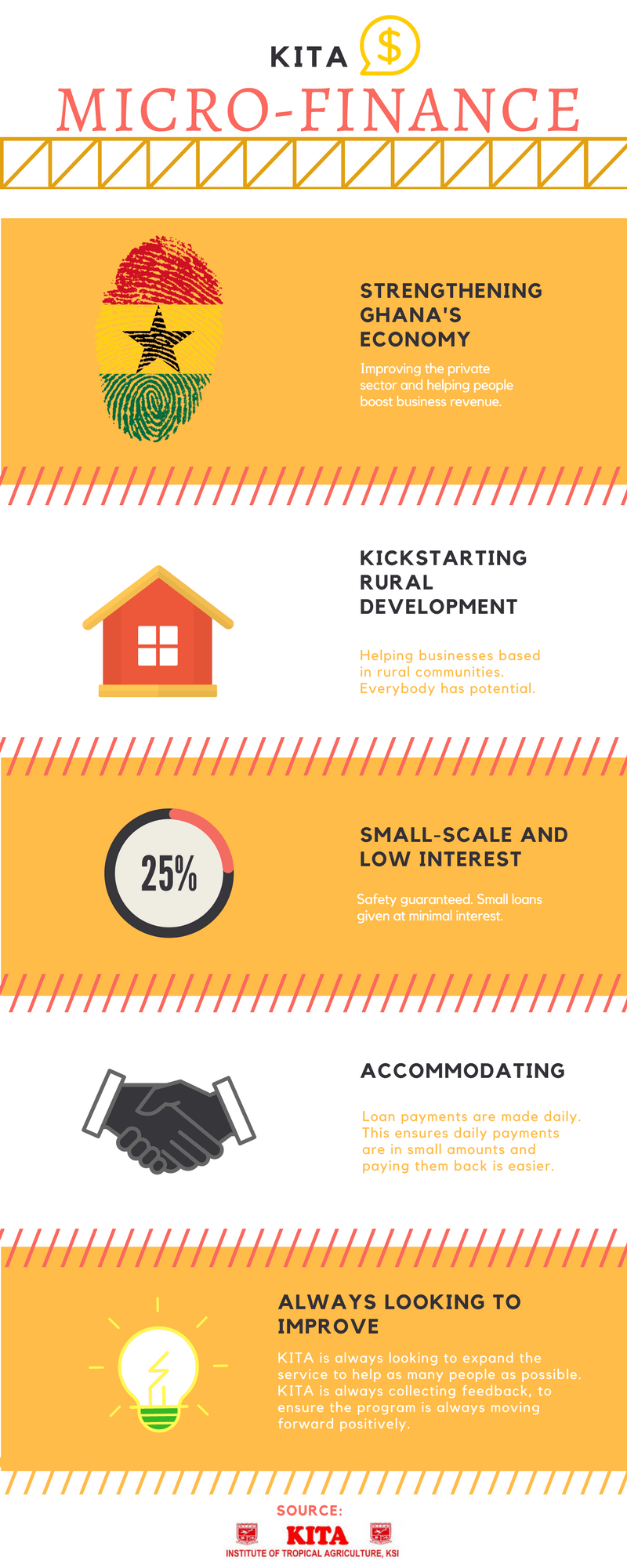

Micro-finance

- By Kamal Mirani

- •

- 11 Feb, 2018

- •

How it started:

Everyday, KITA Micro-finance Agent Ofosu Hene starts his motorcycle and begins his rounds to collect micro-finance payments. He collects these payments amidst a large amount of appreciation from people who have used this financing to help grow their businesses. KITA’s micro-finance scheme began with the realization that many people, especially women involved in farming, just needed a small push to earn an income; not a large amount of financing, simply a small boost. The program started with 10 people in 2016, and was hugely successful, with a 100% repayment rate. This success caused the number to increase to 20 clients in 2017, and has reached nearly 50 in 2018. However, KITA’s program is not looking to establish start-ups, only to help existing businesses.

Why is there a 100% repayment rate?

The primary reason for the 100% recovery rate is KITA’s unique approach of collecting daily payments. When payments are collected daily, the amount is reduced to a more manageable sum. Many micro-finance firms collect their payments on a weekly basis, however by the end of the week, many clients will have spent the money in other ways, and will have little left to pay off their micro-financing. With daily collection, clients are not only reminded to make their payment by the micro-finance agent who visits them every day, but their total daily payment is usually a portion of their daily profit; ensuring they can make their payments every day, rather than a lump sum at the end of the week which will usually have been spent. Other reasons for success include KITA’s efforts to provide limited administrative training and bookkeeping to its clients, which allows them to keep better track of their finances. KITA also generally offers financing to people who are engaged in agriculturally related businesses, or who already have a strong relationship with KITA or the community; this avoids unnecessary risk.

Challenges:

Many of the challenges faced by KITA’s micro-finance program are in fact, relatively positive challenges. For instance, demand for micro-finance has soared, and KITA has accepted new clients every single year, to the point where there is a backlog of over 100 people. KITA is working on funding as many people as possible; while still being financially viable. One challenge that was overcome was the method of payment collection. Originally, people were supposed to make their payments on a weekly basis, however many of them spent their money before paying it back. KITA then resolved to collect payments daily, and while this was challenging logistically, Ofosu Hene, the micro-finance agent, makes daily trips to each one of KITA’s clients to collect payments. While the costs are slightly higher for this method of collection, the fact that it is largely responsible for the program’s 100% repayment rate makes it well worth the cost.

Expenses:

Expenses mainly concern the sum of the money being given out for micro financing (usually ranging from 500-2000 GHC), as well as the salary of the micro-finance agent, the motorbike and fuel, the agent’s daily allowance, and administrative forms and passbooks (for clients to track payments and finances).

Expectations, Demand, and Future Challenges:

Unfortunately, many clients who successfully pay back a micro-finance loan assume they’ll have immediate access to a higher sum loan. While this would be ideal, unfortunately KITA does not always have cash on hand to make this happen. As well as meeting the surging demand, other future challenges include offering more support systems, and digitizing the program with an app and database. Ultimately, while KITA’s micro-finance program needs to expand to better cater to the community there is no denying the impact it makes on people’s small businesses, as evidenced by their ability to consistently pay back their loans.

Everyday, KITA Micro-finance Agent Ofosu Hene starts his motorcycle and begins his rounds to collect micro-finance payments. He collects these payments amidst a large amount of appreciation from people who have used this financing to help grow their businesses. KITA’s micro-finance scheme began with the realization that many people, especially women involved in farming, just needed a small push to earn an income; not a large amount of financing, simply a small boost. The program started with 10 people in 2016, and was hugely successful, with a 100% repayment rate. This success caused the number to increase to 20 clients in 2017, and has reached nearly 50 in 2018. However, KITA’s program is not looking to establish start-ups, only to help existing businesses.

Why is there a 100% repayment rate?

The primary reason for the 100% recovery rate is KITA’s unique approach of collecting daily payments. When payments are collected daily, the amount is reduced to a more manageable sum. Many micro-finance firms collect their payments on a weekly basis, however by the end of the week, many clients will have spent the money in other ways, and will have little left to pay off their micro-financing. With daily collection, clients are not only reminded to make their payment by the micro-finance agent who visits them every day, but their total daily payment is usually a portion of their daily profit; ensuring they can make their payments every day, rather than a lump sum at the end of the week which will usually have been spent. Other reasons for success include KITA’s efforts to provide limited administrative training and bookkeeping to its clients, which allows them to keep better track of their finances. KITA also generally offers financing to people who are engaged in agriculturally related businesses, or who already have a strong relationship with KITA or the community; this avoids unnecessary risk.

Challenges:

Many of the challenges faced by KITA’s micro-finance program are in fact, relatively positive challenges. For instance, demand for micro-finance has soared, and KITA has accepted new clients every single year, to the point where there is a backlog of over 100 people. KITA is working on funding as many people as possible; while still being financially viable. One challenge that was overcome was the method of payment collection. Originally, people were supposed to make their payments on a weekly basis, however many of them spent their money before paying it back. KITA then resolved to collect payments daily, and while this was challenging logistically, Ofosu Hene, the micro-finance agent, makes daily trips to each one of KITA’s clients to collect payments. While the costs are slightly higher for this method of collection, the fact that it is largely responsible for the program’s 100% repayment rate makes it well worth the cost.

Expenses:

Expenses mainly concern the sum of the money being given out for micro financing (usually ranging from 500-2000 GHC), as well as the salary of the micro-finance agent, the motorbike and fuel, the agent’s daily allowance, and administrative forms and passbooks (for clients to track payments and finances).

Expectations, Demand, and Future Challenges:

Unfortunately, many clients who successfully pay back a micro-finance loan assume they’ll have immediate access to a higher sum loan. While this would be ideal, unfortunately KITA does not always have cash on hand to make this happen. As well as meeting the surging demand, other future challenges include offering more support systems, and digitizing the program with an app and database. Ultimately, while KITA’s micro-finance program needs to expand to better cater to the community there is no denying the impact it makes on people’s small businesses, as evidenced by their ability to consistently pay back their loans.

Community Spotlight:

All pictures and interview answers posted with the consent of the interviewee, gathering feedback (both positive and critical) is how KITA improves its programs.

1. Bakery, with Assan Kelsy

Their bakery having received 1500 GHC, Assistant Ms. Kelsy emphasizes that this allows them to buy in bulk from the market, reducing item and transportation costs. It also promotes independence, originally they had to take flour, margerine, and sugar, all on credit, now they can afford to buy it themselves. She claims there are no problems, and it is in fact easier to pay back KITA’s microfinancing because they make a larger profit. However, they wish KITA could help out more with equipment, they are in need of a new oven, bread pans, as well as more transportation options. Should these be give on credit, they are 100% sure they would be able to pay it back due to the revenue it would generate

2. Fried Fish Chop Bar, with Akosua Nyantakyewaa

With 500 GHC invested in her Smoked Fish Chop Bar, this allows her to make more of a profit by purchasing different kinds of fish, which in turn attracts more customers. However, she can’t always afford all the fish she would like, and if certain types of fish aren’t available, it means she loses the business of certain customers. In terms of support, she wishes there was a way to secure better equipment. Right now she uses wood to smoke her fish, which produces a lot of smoke and alters the flavour of the fish; thus, she would need an improved stove.

3. Shop, with Kumah Cecil Aneyor

After receiving 500 GHC for his shop, he is now able to purchase items which he knows there is a demand for, but wasn’t able to purchase before; this attracts more customers. Examples of these items include fresh produce (tomatoes, eggplant, etc.). He was also able to purchase a refrigerator, which in turn increased the number of drinks that were sold. For example he usually sold around 2 bags of sachet water a week, now he sells over 7 bags per week. However, he regrets that he feels not enough training has been provided on record-keeping. More advice and training should be given for management, record-keeping, budgeting (expenses and balance sheets) as well as providing networking opportunities with other businesses. Securing equipment is important, but doing so on credit is still not always easy. For example, say you smoke fish as a business, even if you secure a new machine to smoke the fish, the process is still incomplete if you do not have a refrigerator to store the fish. KITA should think about applying more of their projects as community experiences, such as creating new shop designs, and then building test sites for the community. Any educational articles and videos created by KITA should also be published in the Ashanti Twi language.

4. Bar, with Enock Frimpong

Having received 500 GHC, Enock can now purchase more alcohol in bulk, which has a cheaper per item cost and lower transportation fees. He can now also afford to purchase more live animals for slaughter to provide food. While he has no issues with the program, he wishes there was a better way to provide a structure (right now it is shoddy wood), and new equipment such as refrigerators.

5. Bar, with Fuseini Rashida

After receiving 1500 GHC (split between two people, her partner runs a bushmeat operation) she is able to buy more drinks in bulk, and her partner is able to employ more people and gather more equipment for bushmeat operations. Business is not doing too well as of late, however she thinks this can be changed with more equipment, such as a better refrigerator. She recommends that people who don’t pay back their loans on time (or at all) should not be able to receive more money or should receive some sort of disciplinary action. Conversely, those that do pay on time should receive priority status.

6. Shop, with Rejoice Alorbu

With a micro-finance package of 2000 GHC (two businesses, 1000 GH for a shop and 1000 GH for the farm), she is able to buy more products for her shop, as well as upgrade the poultry facilities of her farm. Unfortunately, sometimes she has to take more money out of one business to cover the costs of the other business, but generally no issues. She recommends quicker money delivery from the time they ask for it (and are approved) and the time they actually receive it.

7. Barber shop, with Kwateng Patrick

With 1000 GHC having been invested, some of the money goes to his wife to engage in trading, and he is also able to afford equipment (stabilizers, hair cutters, etc.) for his two barber shops. He has no major issues, but wishes that the release of money from when they apply and are approved for the program, to when they actually receive it was quicker. The reason for this is because they are always looking to improve their business, delays in payments mean delays in profits.

8. Chop bar, with Yacoubou Adjiatou

After receiving 500 GHC (split between five people who perform different tasks at the chop bar), she is able to buy more materials in bulk, such as milk and maize, which reduces their costs. She has no issues, and the amount of money they have received as well as the program are both fine.

9: Shoemaker, with Collins Cantil

Having received 1,000 GHC, he is now able to buy more shoe-making materials in bulk, reducing their cost. He is now also able to afford large quantities of shoe-making solution (Euroflex), which is used as a binder and glue. As he has just started with KITA, he has no issues. However, he does need a way to secure more equipment (they really need a grinding machine), perhaps more educational support as well.

10. Chop Bar, with Adama Issaka

With 1,000 GHC, she is able to purchase items in bulk, such as meat and rice, for a much lower cost. She has no issues, and her expectations have been met.

Their bakery having received 1500 GHC, Assistant Ms. Kelsy emphasizes that this allows them to buy in bulk from the market, reducing item and transportation costs. It also promotes independence, originally they had to take flour, margerine, and sugar, all on credit, now they can afford to buy it themselves. She claims there are no problems, and it is in fact easier to pay back KITA’s microfinancing because they make a larger profit. However, they wish KITA could help out more with equipment, they are in need of a new oven, bread pans, as well as more transportation options. Should these be give on credit, they are 100% sure they would be able to pay it back due to the revenue it would generate

2. Fried Fish Chop Bar, with Akosua Nyantakyewaa

With 500 GHC invested in her Smoked Fish Chop Bar, this allows her to make more of a profit by purchasing different kinds of fish, which in turn attracts more customers. However, she can’t always afford all the fish she would like, and if certain types of fish aren’t available, it means she loses the business of certain customers. In terms of support, she wishes there was a way to secure better equipment. Right now she uses wood to smoke her fish, which produces a lot of smoke and alters the flavour of the fish; thus, she would need an improved stove.

3. Shop, with Kumah Cecil Aneyor

After receiving 500 GHC for his shop, he is now able to purchase items which he knows there is a demand for, but wasn’t able to purchase before; this attracts more customers. Examples of these items include fresh produce (tomatoes, eggplant, etc.). He was also able to purchase a refrigerator, which in turn increased the number of drinks that were sold. For example he usually sold around 2 bags of sachet water a week, now he sells over 7 bags per week. However, he regrets that he feels not enough training has been provided on record-keeping. More advice and training should be given for management, record-keeping, budgeting (expenses and balance sheets) as well as providing networking opportunities with other businesses. Securing equipment is important, but doing so on credit is still not always easy. For example, say you smoke fish as a business, even if you secure a new machine to smoke the fish, the process is still incomplete if you do not have a refrigerator to store the fish. KITA should think about applying more of their projects as community experiences, such as creating new shop designs, and then building test sites for the community. Any educational articles and videos created by KITA should also be published in the Ashanti Twi language.

4. Bar, with Enock Frimpong

Having received 500 GHC, Enock can now purchase more alcohol in bulk, which has a cheaper per item cost and lower transportation fees. He can now also afford to purchase more live animals for slaughter to provide food. While he has no issues with the program, he wishes there was a better way to provide a structure (right now it is shoddy wood), and new equipment such as refrigerators.

5. Bar, with Fuseini Rashida

After receiving 1500 GHC (split between two people, her partner runs a bushmeat operation) she is able to buy more drinks in bulk, and her partner is able to employ more people and gather more equipment for bushmeat operations. Business is not doing too well as of late, however she thinks this can be changed with more equipment, such as a better refrigerator. She recommends that people who don’t pay back their loans on time (or at all) should not be able to receive more money or should receive some sort of disciplinary action. Conversely, those that do pay on time should receive priority status.

6. Shop, with Rejoice Alorbu

With a micro-finance package of 2000 GHC (two businesses, 1000 GH for a shop and 1000 GH for the farm), she is able to buy more products for her shop, as well as upgrade the poultry facilities of her farm. Unfortunately, sometimes she has to take more money out of one business to cover the costs of the other business, but generally no issues. She recommends quicker money delivery from the time they ask for it (and are approved) and the time they actually receive it.

7. Barber shop, with Kwateng Patrick

With 1000 GHC having been invested, some of the money goes to his wife to engage in trading, and he is also able to afford equipment (stabilizers, hair cutters, etc.) for his two barber shops. He has no major issues, but wishes that the release of money from when they apply and are approved for the program, to when they actually receive it was quicker. The reason for this is because they are always looking to improve their business, delays in payments mean delays in profits.

8. Chop bar, with Yacoubou Adjiatou

After receiving 500 GHC (split between five people who perform different tasks at the chop bar), she is able to buy more materials in bulk, such as milk and maize, which reduces their costs. She has no issues, and the amount of money they have received as well as the program are both fine.

9: Shoemaker, with Collins Cantil

Having received 1,000 GHC, he is now able to buy more shoe-making materials in bulk, reducing their cost. He is now also able to afford large quantities of shoe-making solution (Euroflex), which is used as a binder and glue. As he has just started with KITA, he has no issues. However, he does need a way to secure more equipment (they really need a grinding machine), perhaps more educational support as well.

10. Chop Bar, with Adama Issaka

With 1,000 GHC, she is able to purchase items in bulk, such as meat and rice, for a much lower cost. She has no issues, and her expectations have been met.

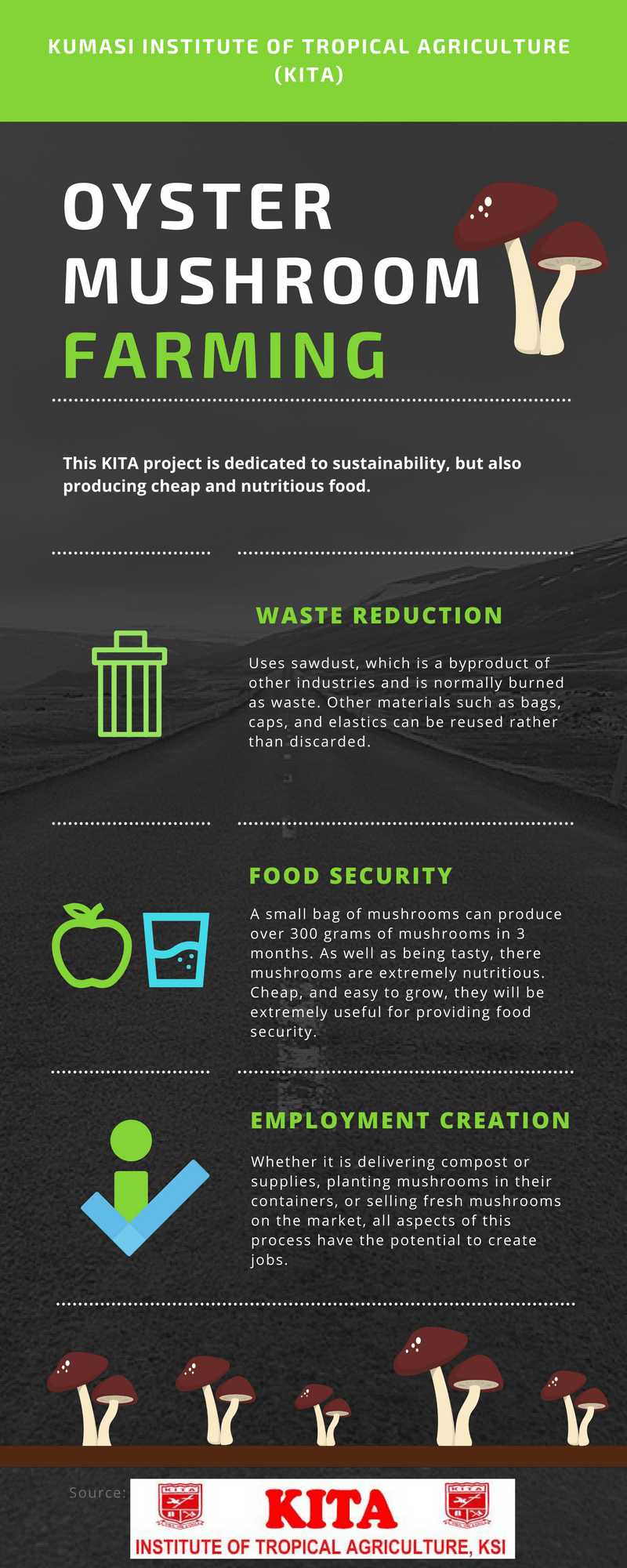

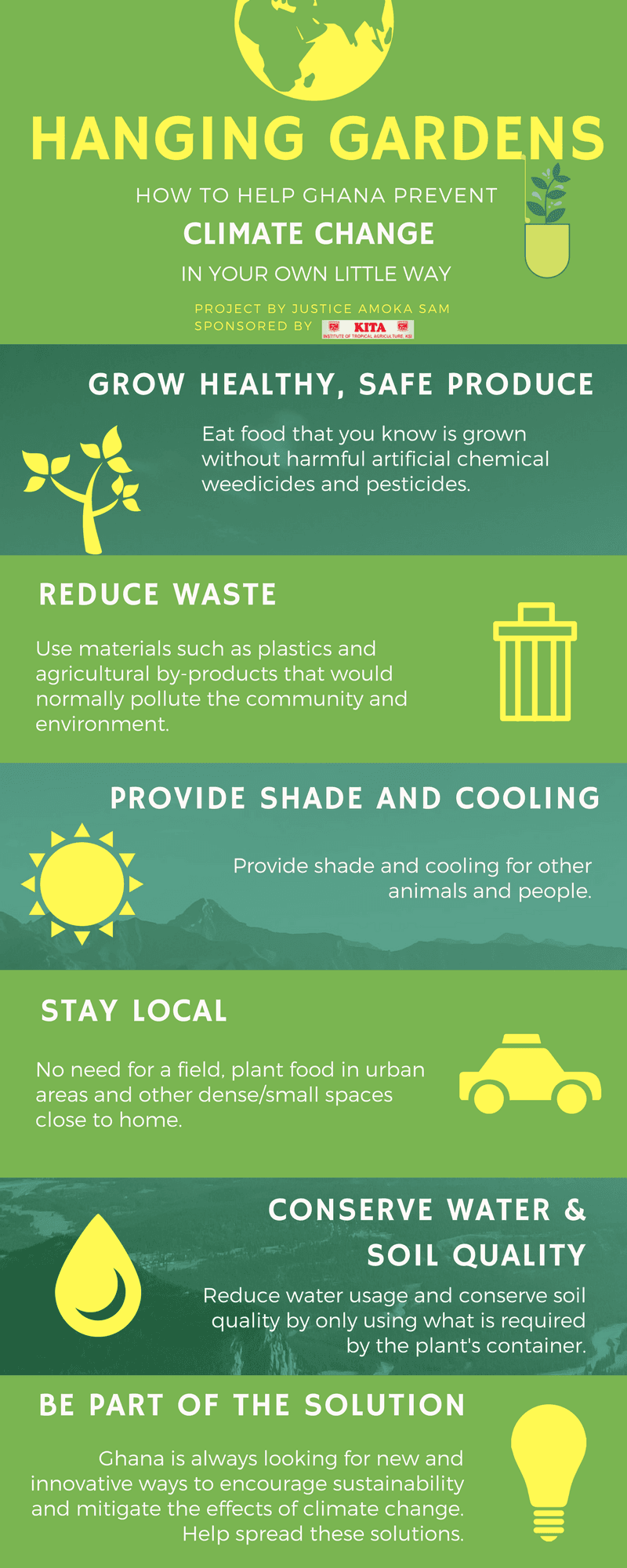

More about KITA:

The Kumasi Institute of Tropical Agriculture (KITA) is a non-profit premier tropical agricultural college in Ghana. We network with: local and global institutions to better the lives of rural farmers, unemployed youth, hungry and homeless families, women, AIDS victims and orphans, needy street children, the aged, and the disabled. This is done through: training, seminars and workshops, technology transfers, on-farm research, environmental conservation, volunteer exchange, seeds and food aid, input and clothing distribution and children’s sponsorship. This has contributed to environmentally sustainable development that enhances the local economy, the nation, and the quality of life in Africa since 1984.

The Kumasi Institute of Tropical Agriculture (KITA) is a non-profit premier tropical agricultural college in Ghana. We network with: local and global institutions to better the lives of rural farmers, unemployed youth, hungry and homeless families, women, AIDS victims and orphans, needy street children, the aged, and the disabled. This is done through: training, seminars and workshops, technology transfers, on-farm research, environmental conservation, volunteer exchange, seeds and food aid, input and clothing distribution and children’s sponsorship. This has contributed to environmentally sustainable development that enhances the local economy, the nation, and the quality of life in Africa since 1984.